ABOUT US

WHO WE ARE

CARDUUS provides first-class Independent Asset Management services to private & institutional clients, entrepreneurs, their businesses and families. Our team offers over 100 years combined professional experience and know-how in financial markets, investments, wealth & asset management, corporate finance and debt raising.

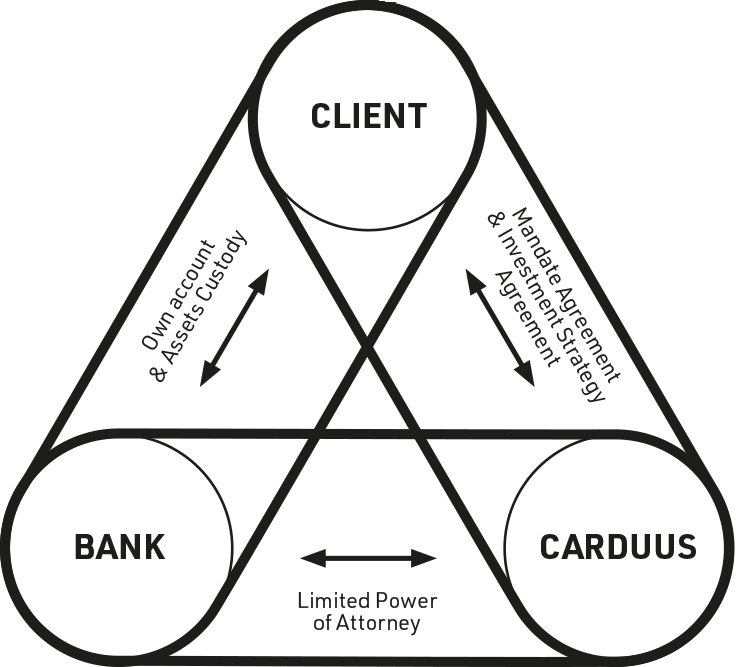

We are passionate about preserving, protecting and appreciating wealth of our clients, focusing on absolute return on their assets. CARDUUS is independent of any financial institution. Our one and only responsibility stands towards our clients and their satisfaction. CARDUUS collaborates solely with top-notch custodian banks. It is our client who decides on the destination for their assets. CARDUUS is licensed by FINMA and is audited by an independent audit company.